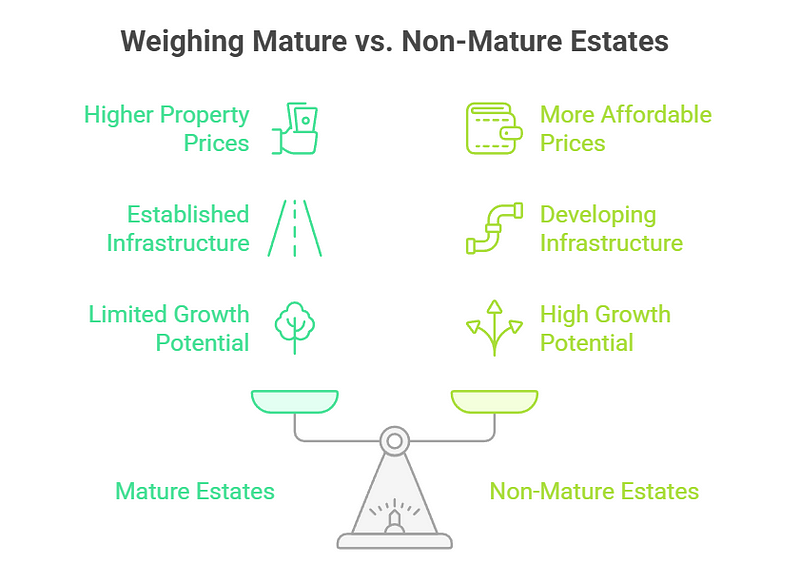

When shopping for an HDB flat or private property in Singapore, one of the most common questions is: Should I buy in a mature or non-mature estate? Understanding the differences between the two can help you make a smarter property decision — whether you’re a first-time homebuyer, upgrader, or investor.

Understanding Mature and Non-Mature Estates

In Singapore, estates are broadly categorized as either mature or non-mature. This classification is primarily based on the age and level of development of the estate, particularly in terms of amenities, infrastructure, and accessibility.

- Mature Estates: These are well-established towns like Toa Payoh, Queenstown, Ang Mo Kio, Bishan, and Tampines. They’ve been developed for decades and come with a full suite of amenities — schools, hawker centres, MRT stations, malls, parks, and polyclinics. Many of these areas are also closer to the city centre.

- Non-Mature Estates: These are newer towns such as Punggol, Sengkang, Tengah, and Bukit Batok West. They may not yet have the same density of amenities but are often part of long-term development plans and see gradual improvement over time as infrastructure is built.

Impact on Property Prices

The maturity of an estate significantly impacts property prices. Generally, properties in mature estates command higher prices due to the following factors:

- Established Amenities: Mature estates offer a wider array of amenities, including shopping malls, hawker centers, schools, healthcare facilities, and recreational spaces. This convenience and accessibility contribute to higher property values.

- Better Connectivity: Mature estates typically have well-established transportation networks, including MRT stations, bus interchanges, and major expressways. This ease of access to other parts of the island makes them more desirable and drives up property prices.

- Larger Unit Sizes: Older properties in mature estates often have larger unit sizes compared to newer developments in non-mature estates. This can be a significant draw for families and those who value space.

- Higher Demand: Due to their established amenities and connectivity, mature estates tend to experience higher demand from both homebuyers and renters. This increased demand puts upward pressure on property prices.

Nonetheless, non-mature estates have its own perks too:

- More Affordable Prices: Newer estates usually offer lower prices, making them attractive for first-time buyers and younger families.

- Investment & Appreciation Potential: Non-mature estates, especially those with major transformation plans (e.g., Punggol Digital District, Jurong Lake District), may see higher percentage appreciation over time as the area develops.

What Should I Buy?

The decision of whether to buy in a mature or non-mature estate depends on individual circumstances, priorities, and investment goals.

Consider a mature estate if:

- Convenience and accessibility are top priorities: You value having a wide range of amenities and excellent connectivity within easy reach.

- Budget is not a major constraint: You are willing to pay a premium for the benefits of living in an established area.

- You prefer larger unit sizes: You are looking for a spacious home for your family.

- You prioritize capital preservation: You want to invest in a property that is likely to hold its value well over time.

Consider a non-mature estate if:

- Affordability is a key concern: You are looking for a more budget-friendly option.

- You are willing to wait for future growth: You are comfortable with the estate developing over time and are willing to invest for the long term.

- You prefer newer developments with modern facilities: You want a home with the latest features and amenities.

- You are looking for potential for higher capital appreciation: You believe that the estate will appreciate significantly as it develops.

Other factors to consider:

- Proximity to workplace: Consider the commute time to your workplace from both mature and non-mature estates.

- Proximity to family and friends: Living near family and friends can provide valuable support and social connections.

- Personal preferences: Consider your lifestyle preferences and whether the estate aligns with your needs and interests.

Wrapping up!

There’s no one-size-fits-all answer. Buying in a mature estate gives you immediate convenience, but you’ll pay a premium. Opting for a non-mature estate means a lower entry price and potential future upside — but with some patience needed for infrastructure to catch up.

If you’re buying for own-stay, think about lifestyle, family needs, and commute. If you’re buying for investment, consider long-term development plans and exit strategy.

Either way, do your research and align your property choice with your financial goals and personal priorities!

Your property questions deserve clear answers—reach out anytime.

Here to help you navigate your HDB journey.

Love & keys,

Rachel 🔑